Who We Are

best in class leadership

Fidem Financial® (Fidem) is a team of industry experts with over 300 years collective experience in all aspects of credit card and consumer lending, including product design, underwriting, pricing, marketing, portfolio acquisitions, and management.

Fidem Track Record

$15.0B

TOTAL RECEIVABLES ACQUIRED

45%+

IRR ON ALL FULLY REALIZED TRANSACTIONS

$53MM

IN LOSS SAVINGS ON FULLY REALIZED TRANSACTIONS UTILIZING FIDEM’S DATA BASE OF NEARLY 5MM U.S. CREDIT CARD CUSTOMERS, WHICH HELPS FIDEM FORESEE EMERGING TRENDS IN THE CARD INDUSTRY

$954MM

EXPECTED CAPITAL CREATION FOR OUR INVESTORS ACROSS ALL FULLY REALIZED AND ACTIVE TRANSACTIONS, ABOVE AND BEYOND FULL INVESTED CAPITAL RETURN

Our Origins

A Market That Changed Overnight

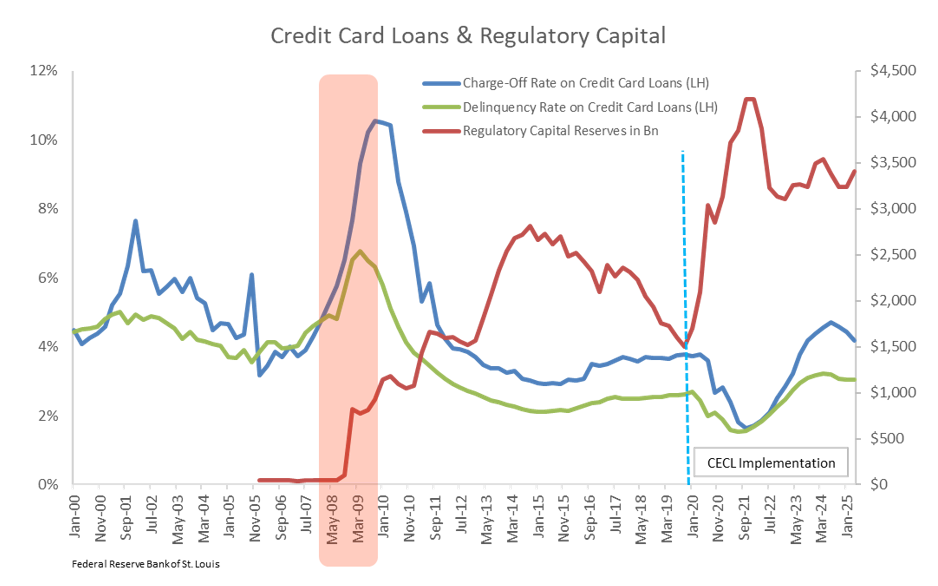

Credit cards remain one of the highest return consumer assets. What changed after the financial crisis was not performance. It was regulation. New capital rules and CECL raised the cost of holding credit card receivables, especially in near prime. Banks now carry significantly more capital against assets that still generate strong yields. The economics stayed attractive, but the capital structure became inefficient.

What the Data Shows

CREDIT CARDS PERFORMANCE DURING GFC- Delinquencies rose to ~6.7-6.8% at 2009 peak but portfolios remained viable

- Charge-offs increased to ~10-11% in 2010 but were absorbed by strong yields

- Consumers prioritized minimum payments, sustaining cash flow

Today: Delinquencies and charge-offs are below pre-pandemic levels

Quarterly Delinquency and Charge-Off Rate on Credit Card Loans, All Commercial Banks

Source: Federal Financial Institutions Examination Council, Consolidated Reports of Condition and Income (Call Reports)

Regulatory Capital Reserves across all bank assets. Board of Governors of the Federal Reserve System (US), Reserves of Depository Institutions: Total [TOTRESNS], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/TOTRESNS, November 20, 2025.

Credit card assets continued to perform even through the worst parts of the cycle, but regulation fundamentally changed bank capital math. CECL and post-crisis rules forced banks to carry far more capital against receivables that still generate strong yields, creating an imbalance between performance and capital treatment. Fidem was founded to correct that imbalance by managing credit with bank discipline and funding it with market efficiency.

The Opportunity That Emerged

A gap opened between asset performance and bank capital requirements.- Banks became constrained.

- Investors still sought exposure to a strong, proven asset class.

- Brands wanted broader approval coverage without losing economics.

Why Fidem Exists

Fidem was founded to manage credit like a bank and fund it like a market. Our model aligns with our mission to responsibly expand access to credit, connect institutional capital to consumers, and deliver stronger value for banks, brands, investors, and consumers.

We bring bank-grade credit discipline together with capital-markets agility. This structure supports financial inclusion, sustainable returns, and a healthier credit ecosystem for everyone it touches.